| UK & Europe | Articles

If you are a regulated firm you will need to show you are meeting the new ‘Consumer Duty’ requirements by April 2023. The second consultation paper, published in December 2021, detailed some rule changes, but the regulator is looking for much more than ‘tick-box’ compliance. Firms must demonstrate that consumer outcomes are considered across the entire ‘distribution chain’ so compliance is unlikely to be straightforward. The level of impact and scale of change will be different for every firm. Reviewing the expectations against each element of your business will give you a clear picture of what you need to get done.

Consumer Duty – where are we now?

The second consultation on ‘A new Consumer Duty’ (CP21/36) closed on the 15 February this year. Since then, firms should have been getting to grips with what it means to them ahead of the final policy statement outlining the new rules which is due to be issued by 31 July. Provided there are no significant changes to the FCA’s proposals, firms will have until 30 April 2023 to implement any necessary enhancements to current practices and ensure their compliance with the ‘Duty’.

The regulator is not looking for fundamental changes to business and operating models, but rather enhancements to existing practices and thinking so that firms can demonstrate consumer outcomes are considered across the entire distribution chain. This includes all stages of product manufacturing and distribution, as well as service execution and ongoing consumer support.

Assessing your Consumer Duty maturity

CP21/36 outlines the proposed handbook rule changes as well as guidance for firms on ‘what good looks like’. Firms should use this information to undertake a detailed maturity assessment of current practices against the expectations of Consumer Duty, and put action plans in place to remedy any areas of weakness or required improvement.

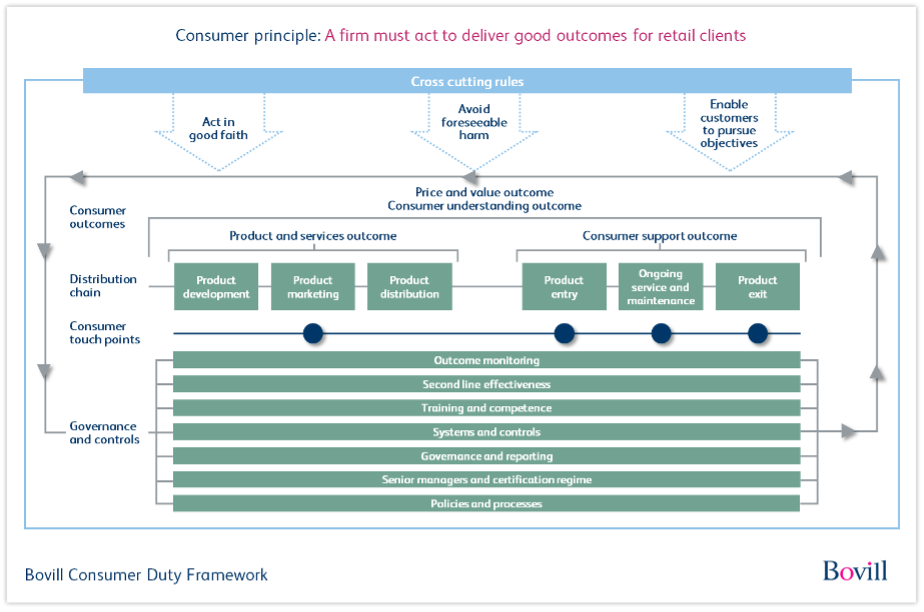

To really understand where change might be needed, firms will need to map out the different elements of Consumer Duty across the different stages in the distribution chain and test the effectiveness of internal governance and control mechanisms. Against this, you should assess both the new rules and guidance coming into effect under Consumer Duty, as well as other relevant areas of the FCA’s handbook already in place to establish where further work might be required.

The four outcomes firms are required to attain under Consumer Duty can be attributed to different parts of the distribution chain. Where ‘price and value’ and ‘consumer understanding’ impact the whole chain, ‘products and services’ focuses on pre-sale activity and ‘consumer support’ on post sale. Firms should therefore consider which processes and stages of the distribution chain the four outcomes will impact, before assessing the maturity.

It is also important to know where the consumer communication touchpoints are throughout the distribution chain to identify where fair communication and disclosure standards apply.

As well as uplifting expectations across the piece, firms need to assess what improvements are required to current governance and control mechanisms. The Consumer Duty predominantly focuses on monitoring of outcomes, and the effectiveness of SM&CR, but firms will need to apply a Consumer Duty lens across all of their governance and control arrangements and uplift accordingly.

Applying effective judgement to the cross cutting rules

Moving forward, firms must embrace the intent and spirit of the Consumer Duty and integrate the new principle and cross cutting rules into everything they do. The Consumer Duty doesn’t detail how firms should meet the expected standards. However, firms have been operating within a principle based regulatory framework for some time and should be used to applying a level of judgement, proportionality, and understand the need to evidence they are doing everything needed to:

- Act in good faith

- Avoid foreseeable consumer harm; and

- Enable customers to pursue their financial objectives

A focus on behavioural economics

Consumer behavioural biases are referenced throughout the Consumer Duty. Firms must understand how behavioural biases can contribute to consumer harm, be equipped to identify where and when this might occur, and act accordingly.

Firms need to consider how data can help them ensure fair customer outcomes and identify and manage risks appropriately.

More consumers transition to digital journeys each day, so firms must consider the potential risks and negative consequences of this and adapt accordingly. The FCA has recently presented behavioural economic considerations and ‘positive friction’ tactics in its work on crypto-assets and high-risk investment products. There are also lessons from pension freedoms inertia and consumer protection advancements in the gambling sector. Different consumer journeys and demographics present different risks and behavioural biases which need to be appropriately considered as part of Consumer Duty compliance.

We’re here to help

The impact of Consumer Duty is far reaching for all firms, but the severity of change will be dependent on a firm’s size, nature, products, customer demographic, and the standard of compliance with today’s regulatory rules and guidance.

We have developed a Consumer Duty compliance tool kit to help firms assess and benchmark their maturity against the new standards. Our tool kit maps the different elements of Consumer Duty to the different stages in the distribution chain and internal governance and control mechanisms using the framework illustrated above. We have a library of requirements that takes account of both new rules and guidance coming into effect under Consumer Duty, as well as other relevant areas of the FCA’s handbook. We test and score firms against relevant rules and guidance to establish where action needs to be taken. We can then help to put together an action plan to make sure you are compliant by April 2023.