| UK & Europe | Articles

The FCA’s Consumer Duty is due to come into effect in April 2023. Although it may be a continuation of what’s gone before, the new Principle gives the regulator teeth when it comes to non-compliance. You will need to be able to provide clear evidence you are meeting the new requirements so it’s important to identify any shortfalls as soon as possible to give yourself time to address them.

The FCA’s expectation of ‘consumer first’ is nothing new. The FCA – and before them the FSA – have introduced concepts of Treating Customers Fairly, Consumer Outcomes, Culture and now Consumer Duty. Each has been a progression of the last. With each change the FCA aimed to dig deeper into the mindset, embedded internal workings, and consumer instincts of an organisation. The focus must always be ‘consumer first’ when making any decision and undertaking any action.

There have certainly been improvements over recent years as firms have got to grips with the FCA’s intent around consumer outcomes and culture. However, it is not enough.

Some sectors are further along their journey than others, some firms are further than peers. Arguably those which have been in the regulators crosshairs or under closer supervision are in better shape because they’ve had to be.

What does seem common is a lack of permanence when it comes to progress. There is often an initial flurry of activity, with consumer-related risks and issues soaring to the top of committee and board agendas immediately after policy implementation, only to fade away as other ‘business priorities’ take precedent over time and the consumer focus starts to diminish. Not necessarily back to the previous state, but falls back none the less. And so the regulator needs to move the dial once again.

What is the FCA’s Consumer Duty?

The FCA published a new consultation paper on its Consumer Duty in December: CP21/36: A new Consumer Duty which followed the original consultation published in May: CP21/13: A new Consumer Duty. The Consumer Duty is intended to “set clearer and higher expectations for firms’ standards of care towards consumers”.

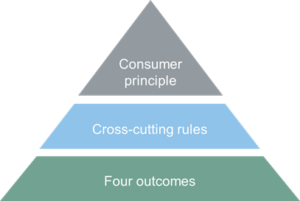

The Consumer Duty brings together four outcomes, three cross-cutting rules, and one consumer principle.

Meeting the FCA’s ‘Four Outcomes’ for consumers

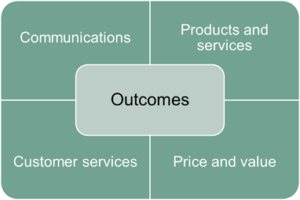

The outcomes are considered in detail in the FCA’s consultation paper and include: design and distribution of products and services; price and value; customer communications; and customer contact on behalf of another firm.

Regulatory scrutiny in these areas is not new, but arguably they haven’t been given the attention they deserve by firms. Product governance is typically low on a firm’s agenda. Fair pricing and value for money has made progress in some areas – insurance, short term high cost loan price capping, contingent charging banning. But more widely any real internal activity in this space has fallen short.

Customer communications have certainly improved in recent years but we still see instances of what could be seen as mis-leading information and customers not being in a fully informed position when making decisions.

Outsourcing governance and oversight arrangements have recently been a regulatory hot topic, with proposed changes to the Appointed Representative regime also being consulted on currently in CP21/34. All of these areas are interlinked and have a direct impact on consumer outcomes.

Firms need to think about their business model and offering as a whole, rather than in siloed parts of the customer journey as many can be found guilty of in the past.

The ‘Three cross-cutting rules’ and the risk of foreseeable harm

If firms have been truly focused on consumers, and aligning their culture and practices to regulatory expectations, these might not seem overly burdensome. For the firms who feel they fall short, you must act now.

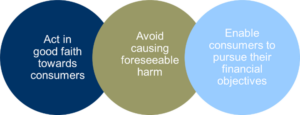

There are three cross-cutting rules:

- Act in good faith toward retail customers

- Avoid foreseeable harm to retail customers

- Enable and support retail customers to pursue their financial objectives

Our experience suggests that firms will likely feel they largely comply with 1 and 3, however 2 may be where they fall short. It is easy to focus on today rather than tomorrow (or some point in the long distant future), and coupled with typical human behavioural ‘present-bias’, that is often what happens. Thinking about how the risk of ‘foreseeable harm’ can be managed is something firms should thoroughly consider and act on where necessary.

Making sure you have met the new Consumer Principle

Governing all these elements, is the new ‘Consumer Principle 12 – A firm must act to deliver good outcomes for retail customers’. Again, this will look and feel bigger to some firms than others. Regulatory fines typically pin back to the breach of a Principle. So firms who do not act accordingly on Consumer Duty, may find themselves being one of the first to experience regulatory censure in breach of Principle 12.

Treatment of consumers in vulnerable circumstances will continue to be scrutinised under Consumer Duty and is a lens which the FCA will likely use when testing a firm’s adherence to Consumer Duty. It would be prudent for firms to revisit their practices when it comes to consumer vulnerability to ensure they remain, and continue to remain, fit for purpose.

The FCA also expects firms to be able to demonstrate they can comply with Consumer Duty at authorisation stage. So firms seeking future FCA authorisation will need to ensure this is appropriately factored into their business plans and applications.

The FCA have said they expect to make any new rules by the 31st of July 2022. Currently, firms have until 30 April 2023 to fully implement the Consumer Duty. Whether there is much to be done to meet them will depend on the firm, but now is certainly the time to find that out.

We can help

We have over twenty years experience helping firms with conduct and consumer outcomes. We are currently working with clients to understand how to meet the new Consumer Duty and to develop effective ways to evidence their compliance with the FCA’s expectations should they come under scrutiny. Get in touch to find out more about carrying out a gap analysis against our Consumer Duty framework.